Current data shows shifting dynamics in Daytona Beach’s housing market. In this October 2025 update, we analyze median prices, inventory, days-on-market, neighborhood trends, and make predictions for the rest of the year.

| Metric | Value / Trend | Notes / Comparison YoY |

|---|---|---|

| Median Sold Price | ~$306,811 | Down ~1.7% compared to same period last year Rocket Mortgage |

| Median List Price | $403,364 | Up ~9% year-over-year (October 2025 vs 2024) My Broker One |

| Price Per Square Foot | ~$203 | As per recent June 2025 data Rocket Mortgage |

| Days on Market (DOM) | ~79 days | Some reports show ~79 days average Realtor+1 |

| Sale-to-List Ratio | ~96–97% | Homes selling slightly below asking price on average Realtor+2Zillow+2 |

| Inventory / Active Listings | Rising strongly (50–70% year-over-year) | Especially in Volusia County / Daytona Beach region Jared Jones Real Estate Team |

| Neighborhood Spotlight: Daytona Beach Shores | Median down ~25% YoY, ~99 DOM Redfin |

Takeaway: The market is cooling slightly. Prices are relatively stable or modestly declining, while inventory is climbing — giving buyers more options and less pressure to rush.

Line chart of Median Sold Price over the last 12 months

Bar graph comparing Active Listings vs Closed Sales quarterly

Map overlay: Neighborhood price heatmap (e.g. by ZIP code)

Pie chart: Sales by home type (single-family, condo, townhome)

These visuals are engaging, make data digestible, and help your readers grasp trends at a glance.

Inventory in the Daytona / Volusia region is rising steeply , some reports suggest a 50–70% increase year-over-year in key markets.

This shift gives buyers more choices and less competition. Sellers may need to be more strategic with pricing.

Some data shows slight declines year-over-year (e.g. –1.7% in median sold price) while others show modest increases depending on ZIP and home type

The variance suggests that micro-markets (neighborhoods, condos vs houses) matter more than broad averages.

Homes are spending more days listed, giving buyers time to negotiate.

With more choices and less urgency, buyers can push for better terms, inspections, or contingencies.

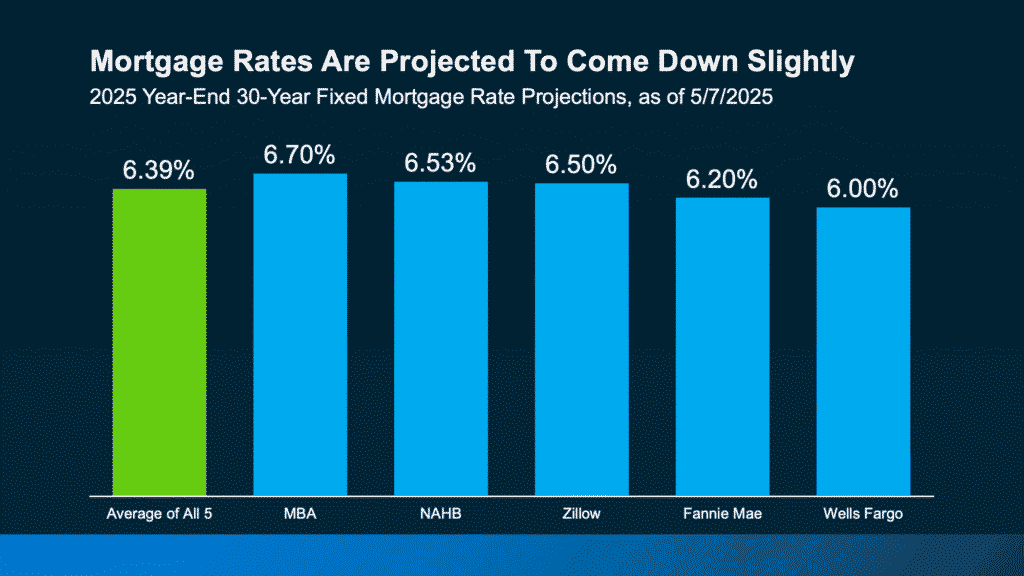

Mortgage rates remain high relative to historical lows, constraining some buyers.

In Florida, rising homeowners insurance (especially in coastal zones) is an added cost burden and can affect affordability.

The broader Florida real estate market is also cooling in some regions, adding macro pressure.

Daytona Beach Shores: drastic YoY drop (~25%), DOM ~99 days

Condos & Waterfront Properties: These tend to be more volatile. Premium features (ocean views, direct beach access) still carry premiums, but less desirable units may see steeper declines.

Inland vs Coastal Zones: Inland ZIP codes might show more stability as they are less exposed to insurance and climate risks.

New Construction & Land / Lots: The average list price for lots in Daytona fell year-over-year in recent data, indicating softer demand for raw land.

Moderate Price Pressure

Expect modest downward pressure or stabilization, especially in non-premium homes.

Premium, well-maintained, move-in-ready homes may still hold value or even appreciate.

More Negotiation & Buyer Leverage

Buyers will likely have more leverage: more inspections, price reductions, closing cost incentives, etc.

Inventory Growth Continues

As new build completions come online and some sellers act out of urgency, inventory could continue to increase.

Micro-Market Differentiation

Neighborhoods, condition, views, and amenities will differentiate performance sharply. The gap between “good” and “average” homes will widen.

Seasonal & External Risks

Be watchful of hurricanes, insurance premium spikes, interest rate changes, and regulatory changes in coastal zones—which can quickly impact buyer sentiment.

Shop smart, compare multiple neighborhoods, home types, and avoid overpaying.

Use inspections & contingencies, sellers are more open to concessions.

Watch financing and lock rates when favorable.

Focus on homes in good shape or with desirable features, they’ll resist downward trends.

Price competitively from day one; avoid overpricing.

Invest in staging, curb appeal, small repairs, distinguishing features matter.

Be open to negotiations (closing costs, updates, flexible terms).

Work with an agent who deeply knows local micro-markets (ZIP, street-level trends).

The October 2025 Daytona Beach real estate market is entering a more balanced phase. After years of overheated demand, buyers are getting breathing room. Some sellers will feel pressure, especially with rising inventory and external cost headwinds. But opportunities remain, especially for well-positioned homes and savvy negotiators.

If you want a custom report for your ZIP code, neighborhood, or property type, or want help interpreting what this means for your buying or selling goals , feel free to let me know. I’d be glad to customize for your audience.

Call to Action (CTA):

“Want a free local home valuation or neighborhood-specific insight? Contact us today, we’ll send you a personalized report with comparable home sales, pricing strategy, and more.”